Job Market Paper

Accommodative Monetary Policy Shocks Do Not Stimulate Output

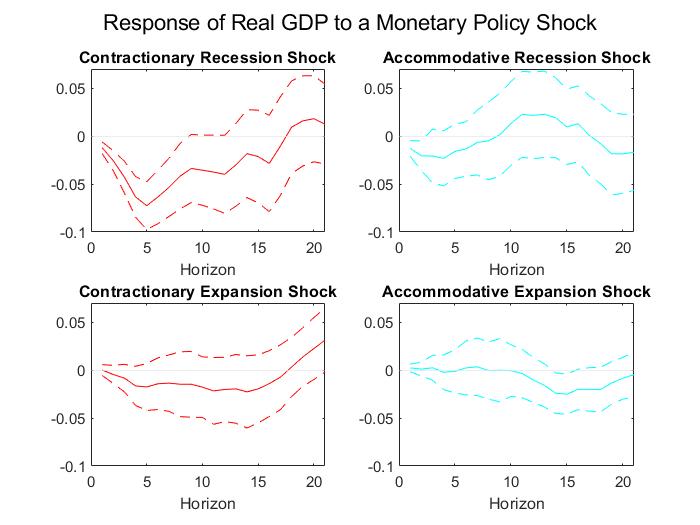

This paper investigates whether the response of U.S. output to a monetary policy shock is symmetric over three dimensions: the direction of the shock, the size of the shock, and what phase the business cycle is in when the shock takes place. Theory suggests that looking at individual asymmetries may not tell the whole story and that interactions among the asymmetries may be important. My results show that business cycle and directional asymmetry are important while the size of the shock is not. In addition, the directional asymmetry results are being driven by monetary policy stimulus having little effect on output. This calls into question the ability of traditional monetary policy to combat recessions.

This Figure contains the response of output to a monetary policy shock when local projections is run on a model that includes directional asymmetry, business cycle asymmetry, and the interction between the two. A distinction is made between what phase of the business cycle that the shock takes place during and whether the shock is positive or negative in this figure. The two main finidings here are that accommodative shocks have no significant effects on output and that monetary policy shocks taken during recessions have more of an effect on output.